ANTENNAS TO ORBIT

Ground stations are Earth's link to space. Demand is surging as command, communications, and data relay needs grow along with expanding satellite networks, military operations, and space exploration.

RISE OF GROUND STATIONS

Ground stations are Earth’s link to space - the nervous system of space infrastructure. Every satellite, GPS signal, and deep-space probe relies on ground stations to send and receive information. Every mission control command and every image or message from space flows through these critical hubs. As a result, ground station networks have profound strategic, commercial, and military implications.

A satellite ground station consists of specialized equipment, including antennas, receivers, transmitters, and data processing systems. A large parabolic dish antenna is used to send signals to and receive signals from satellites. Ground stations communicate with satellites to upload commands, download data, monitor satellite health, and adjust orbits as necessary. Ground station infrastructure is extensive concentrated among spacefaring nations like United States, China, Russia, and members of the European Union. The United States leads in satellite ground operations, driven by a mix of government and private sector activity. Emerging markets and the increasing role of commercial satellite networks is contributing to global expansion.

Today, many legacy ground stations - built during the Cold War and early space age - are undergoing upgrades to support modern satellite constellations, higher data rates, and secure communications. At the same time, new commercial ground stations are being built to meet the growing demand from proliferating low-Earth orbit (LEO) constellations, lunar missions, and military applications. Companies like Northwood and AnySignal are part of this transformation, offering modern, flexible, software-based ground station solutions to improve efficiency and expand accessibility. Other innovations, such as optical communications and relay satellite networks, could further supplement traditional dish-based infrastructure.

There have been significant investments from both government and private sectors. The satellite ground station industry is projected to be worth over $115 billion by 2028. Major deals like EQT's acquisition of an 80% stake in Eutelsat Group's Ground Station Infrastructure Business, valued at approximately €790 million, point to increasing private equity interest in this sector. A new era of space connectivity is dawning.

TABLE OF CONTENTS

GROUND STATIONS FROM SPUTNICK TO STARLINK

THE ESTABLISHED GROUND STATION INDUSTRY

STARTUPS TRANSFORMING THE INDUSTRY

Startup Profile: Northwood Space

Market Size and Growth Projections

Public and Private Capital Invested

GROUND STATIONS FROM SPUTNICK TO STARLINK

The first satellite ground stations emerged with the launch of the Soviet satellite Sputnik 1 in 1957. The United States and the Soviet Union established tracking networks to monitor satellites and collect telemetry data. NASA’s Deep Space Network (DSN) was founded in 1958 to support interplanetary missions, and the US military developed its own ground station infrastructure for reconnaissance and early warning satellites.

By the 1960s, commercial satellite communications gained traction with the launch of the Bell Labs Telstar 1 in 1962 and NASA’s geostationary communications satellite Syncom 3 in 1964. These satellites required dedicated earth stations, leading to the construction of landmark facilities like the Andover Earth Station in Maine. The International Telecommunications Satellite Organization (INTELSAT) was established in 1964 to coordinate satellite spectrum and orbital slots to prevent interference. This grew to a global satellite network by the 1980s further driving the expansion of ground station networks.

Geostationary communication satellites proliferated in the 1970s and drove an expansion of more, and more sophisticated, and widely distributed ground stations. The development of parabolic dish antennas with high-gain capabilities enabled improved signal reception and transmission. The military expanded its use of satellite ground stations for secure communications, intelligence, and early warning systems.

In the 1980s and 1990s, advancements in digital signal processing and automation improved the efficiency of ground stations. The rise of LEO satellites, like the Iridium and Globalstar constellations, required ground station networks capable of tracking multiple fast-moving satellites. Meanwhile, the DSN continued supporting deep-space missions, including the Voyager probes and Mars exploration missions.

Through the 2000s, there has been an explosion of satellite activity, including constellations like Starlink, OneWeb, and Amazon’s Kuiper. These networks require global ground station infrastructure to maintain continuous connectivity (Unlike GEO satellites which hover above a fixed spot on earth, LEO satellites move across the Earth quickly in orbit requiring continuous contact points). Cloud-based ground stations have expanded allowing other companies to purchase the services instead of having to build their own station, and software-defined ground stations have emerged reducing the amount of hardware that is needed for a ground station (see later profiles of companies like Northwood, AnySignal, and Infostellar). The US Space Force and private companies are investing in autonomous and AI-driven ground station operations to enhance real-time responsiveness and security.

THE ESTABLISHED GROUND STATION INDUSTRY

STARTUPS TRANSFORMING THE INDUSTRY

Startup Profile: AnySignal

Pioneering Advanced RF Solutions for Aerospace and Defense

Founded in 2022 and headquartered in El Segundo, CA, AnySignal specializes in developing advanced radiofrequency (RF) connectivity and sensing platforms for aerospace and defense sectors. An RF platform is an integrated system that manages the transmission and reception of electromagnetic signals across various frequencies. These platforms are essential for secure communication, radar operations, electronic warfare, and navigation systems. Currently, RF functionalities are often distributed across multiple specialized systems, leading to increased complexity and potential interoperability challenges. AnySignal is building a modernized platform to unify these capabilities into more flexible, software-defined systems, enhancing adaptability, reducing hardware redundancy, and improving resilience against emerging threats.

AnySignal company leadership brings deep expertise:

John Malsbury (CEO) - Formerly with SpaceX, managed signal processing development across projects including Dragon 2, Starship, Starlink, Starshield, and Falcon 9.

Jeffrey Osborne, Ph.D. (COO) - Co-founder of Kepler Communications, brings extensive experience in satellite communications and operations.

Ricardo Medina (Engineering Director) - Previously with DigitalOcean and GitHub, contributes expertise in software engineering and infrastructure.

The AnySignal product line includes:

Rugged Hardware: Multi-band RF systems designed for extreme conditions, combining advanced processing with space-grade hardware for mission-critical operations.

DSP Framework: A high-speed digital signal processing framework enabling real-time signal processing, rapid prototyping, and adaptive waveform control.

AnyLink Network: A comprehensive RF networking platform that integrates seamlessly with various satellite networks, facilitating unified operations and intelligent scheduling.

These technologies support applications in space communications, autonomous systems, electronic warfare, and radar systems, addressing the evolving needs of the defense and aerospace markets.

In February 2024, AnySignal announced a strategic partnership with Vast, a leader in space habitation technologies, to develop an advanced communication system for Vast's upcoming Haven-1 space station. AnySignal has raised a total of $11.7 million across two (oversubscribed) funding rounds: a $5 million seed round in October 2023, and a $6.7 million Series A in December 2024. These investments are being used to accelerate production and expand research and development efforts to fulfill a log of customer contracts.

Startup Profile: Northwood Space

Revolutionizing Satellite Backhaul with Scalable Ground Infrastructure

Founded in 2023 and headquartered in El Segundo, CA, Northwood Space is modernizing satellite backhaul to support a growing space ecosystem. Satellite backhaul is the process of transmitting data from end-user equipment, like cell phones, to a central system via satellites. Traditionally, this has involved the use of large, expensive, bespoke ground stations with long construction timelines that limit scalability. Northwood aims to transform this landscape by developing ultra-wideband gateways that are designed for scalable volume manufacturing with the added benefit of supporting iterative development.

Northwood was co-founded by:

Bridgit Mendler, Ph.D. (CEO) - Former Disney Channel star who transitioned to academia at Harvard Law School and earning a Ph.D. from MIT. She has former experience at the Federal Communications Commission's Space Bureau, gaining expertise in space law and regulation.

Griffin Cleverly (CTO) - With degrees in Mechanical, Electrical, and Computer Engineering, he was formerly at Lockheed Martin and MITRE specializing in aircraft and satellite systems.

Shaurya Luthra (Head of Software) - With degrees in Electrical and Computer Engineering, he had been a senior manager of engineering and ground station architecture at Capella Space. Prior to Capella, he had been at Lockheed Martin focusing on cloud-native data solutions.

Northwood aims to transform the ground station landscape by developing a network of ultra-wideband gateways that are:

Designed for Manufacturing: Implementing volume manufacturing with iterative development enables proactive deployments.

Scalable: Dynamic capacity provisioning through horizontally scalable architecture allows for flexible expansion.

Resilient: Eliminating single points of failure while anticipating irregularities and disruptions ensures continuous and reliable operations.

This modernization is essential for growing space operations. The ground station network is a critical chokepoint in space operations, and a scalable, reliable network will be needed to meet growing demand.

Northwood has raised a total of $6.4 million: a $100,000 grant from Harvard Innovation Labs in February 2023, and a $6.3 million seed round in February 2024. These investments are being used to build production and scale operations.

INVESTMENT LANDSCAPE

Market Size and Growth Projections

The satellite ground station industry is experiencing significant growth, driven by the increasing demand for satellite-based services. From a current approximately $62 billion market in 2024, growth is projected to $209 billion by 2034, with a 13% CAGR (Markets and Markets, 2023: https://www.marketsandmarkets.com/Market-Reports/satellite-ground-station-market-98562261.html; Allied Market Research, 2023: https://www.alliedmarketresearch.com/satellite-ground-station-market-A107603; Global Market Insights, 2023: https://www.gminsights.com/industry-analysis/satellite-ground-station-sgs-market). This projection is based on a continued high launch tempo, driven by increasing numbers of active satellites, including in constellations like SpaceX Starlink, Amazon Kuiper, and OneWeb, driving demand for more ground stations for connecitivity. It is possible that technology, like inter-satellite relay, could replace some ground station demand, but would be small in comparison to robust demand growth in both defense and commercial markets.

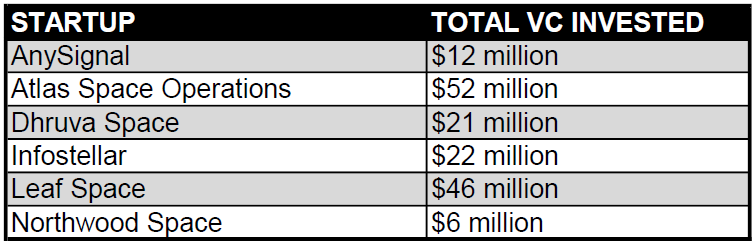

Public and Private Capital Invested

Governments worldwide are investing in satellite communications, and the associated infrastructure including ground stations. For examples:

The US Space Development Agency (SDA) awarded contracts totaling approximately $1.8 billion for the first operational data transport satellites under the Tranche 1 Transport Layer (T1TL) program.

The UK Space Agency awarded £16 million to British electronics firms to enhance secure satellite communications and internet access in rural areas.

The UK Ministry of Defence contracted Airbus Defence and Space to build the Skynet 6A satellite, with a contract valued at over £500 million, including launch, testing, and related ground operations improvements.

The India Ministry of Defence signed a ₹3,000-crore (approximately $400 million) agreement with NewSpace India Limited (NSIL) for the procurement of the advanced communication satellite, GSAT 7B, to meet the requirements of the Indian Army.

Mergers & Acquisitions

The broader defense and space sectors are actively consolidating, with major acquisitions happening in satellite manufacturing, AI, launch services, and space infrastructure. While ground stations haven’t yet been seen high-profile M&A, the same market forces apply; similar consolidation trends could emerge in the next few years.

Ground stations are critical infrastructure. The growing number of satellites requires more scalable and resilient ground networks. Companies providing automated, software-defined, and multi-mission ground solutions could become prime acquisition targets. Legacy companies like Lockheed Martin, Northrop Grumman, Airbus, and Raytheon may acquire ground station firms to complement their satellite programs. Eutelsat’s merger with OneWeb provides an example of a communications company securing ground infrastructure. The DoD and allied space agencies are increasing investment in resilient satellite communications and protected ground networks. Acquiring ground station companies could help defense contractors build end-to-end secure satellite services. This will provide venture-backed start-ups with exit strategies.

THE FUTURE OF GROUND STATIONS

The future of satellite ground stations echoes the trends seen in the transition from legacy defense and legacy launch to modernized, software-enabled, scalable hardware. As the number of satellites in orbit explodes, and demand for resilient, high-speed communications grows, demand for ground infrastructure will grow with it. Cutting-edge startups provide great investment opportunities now. Strategic acquisitions and large government investments are expected, as the backbone of a large and connected space economy forms.